All Categories

Featured

Table of Contents

In case of a gap, impressive plan financings in excess of unrecovered price basis will go through common revenue tax obligation. If a plan is a changed endowment contract (MEC), policy lendings and withdrawals will certainly be taxable as regular income to the extent there are incomes in the policy.

It's essential to note that with an external index, your plan does not directly get involved in any type of equity or fixed revenue financial investments you are not purchasing shares in an index. The indexes offered within the plan are constructed to keep track of diverse sections of the U.S

Who offers Iul Interest Crediting?

An index might influence your interest credited, you can not buy, directly get involved in or get returns repayments from any of them via the policy Although an exterior market index might influence your interest attributed, your plan does not directly take part in any kind of supply or equity or bond investments. Guaranteed interest IUL.

This web content does not use in the state of New york city. Warranties are backed by the monetary stamina and claims-paying capability of Allianz Life Insurance Coverage Firm of North America. Products are released by Allianz Life Insurance Coverage Business of The United States And Canada, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. .

Safeguard your loved ones and conserve for retired life at the exact same time with Indexed Universal Life Insurance Policy. (Guaranteed interest IUL)

Indexed Universal Life

HNW index universal life insurance coverage can help collect cash money value on a tax-deferred basis, which can be accessed during retirement to supplement income. (17%): Insurance holders can often borrow against the money worth of their policy. This can be a source of funds for various demands, such as buying a business or covering unforeseen expenses.

The survivor benefit can help cover the expenses of searching for and training a substitute. (12%): In some instances, the money worth and death advantage of these plans might be safeguarded from lenders. This can supply an additional layer of monetary safety and security. Life insurance policy can likewise assist lower the danger of a financial investment profile.

Why do I need Guaranteed Interest Iul?

(11%): These plans supply the potential to earn interest connected to the performance of a securities market index, while likewise providing a guaranteed minimum return (IUL death benefit). This can be an appealing alternative for those looking for growth capacity with downside defense. Funding for Life Research 30th September 2024 IUL Study 271 respondents over 30 days Indexed Universal Life insurance policy (IUL) may seem complicated initially, but comprehending its mechanics is crucial to comprehending its complete capacity for your financial preparation

If the index gains 11% and your engagement price is 100%, your money value would certainly be attributed with 11% interest. It is essential to keep in mind that the maximum rate of interest attributed in a given year is capped. Allow's state your picked index for your IUL plan obtained 6% from the get go of June to the end of June.

The resulting passion is included in the cash money worth. Some plans determine the index obtains as the sum of the changes through, while other policies take approximately the everyday gains for a month. No passion is attributed to the cash account if the index drops rather than up.

Who are the cheapest Indexed Universal Life Growth Strategy providers?

The rate is set by the insurance coverage business and can be anywhere from 25% to even more than 100%. IUL plans normally have a flooring, frequently established at 0%, which shields your money worth from losses if the market index carries out negatively.

This supplies a degree of safety and security and satisfaction for policyholders. The rate of interest attributed to your cash value is based on the performance of the picked market index. A cap (e.g., 10-12%) is usually on the maximum rate of interest you can make in a given year. The section of the index's return credited to your cash money worth is figured out by the engagement rate, which can vary and be changed by the insurer.

Store about and compare quotes from various insurance coverage business to locate the ideal plan for your requirements. Before picking this type of policy, ensure you're comfy with the potential changes in your cash money worth.

What is the most popular Indexed Universal Life Policyholders plan in 2024?

By comparison, IUL's market-linked cash money value development provides the potential for higher returns, especially in beneficial market conditions. However, this potential features the threat that the securities market performance might not supply constantly stable returns. IUL's adaptable costs repayments and adjustable survivor benefit provide adaptability, appealing to those seeking a policy that can progress with their altering financial conditions.

Indexed Universal Life Insurance Policy (IUL) and Term Life Insurance coverage are various life plans. Term Life Insurance coverage covers a specific period, usually between 5 and 50 years.

It is ideal for those seeking short-lived defense to cover particular financial responsibilities like a home financing or youngsters's education and learning fees or for service cover like shareholder defense. Indexed Universal Life (IUL), on the various other hand, is a permanent life insurance policy plan that supplies coverage for your whole life. It is more expensive than a Term Life policy due to the fact that it is made to last all your life and offer an assured cash money payout on death.

How do I apply for Indexed Universal Life Policy?

Picking the appropriate Indexed Universal Life (IUL) plan has to do with locating one that lines up with your economic goals and take the chance of tolerance. A knowledgeable financial expert can be important in this process, guiding you via the complexities and guaranteeing your picked plan is the appropriate suitable for you. As you investigate buying an IUL policy, keep these key considerations in mind: Understand just how credited interest prices are linked to market index performance.

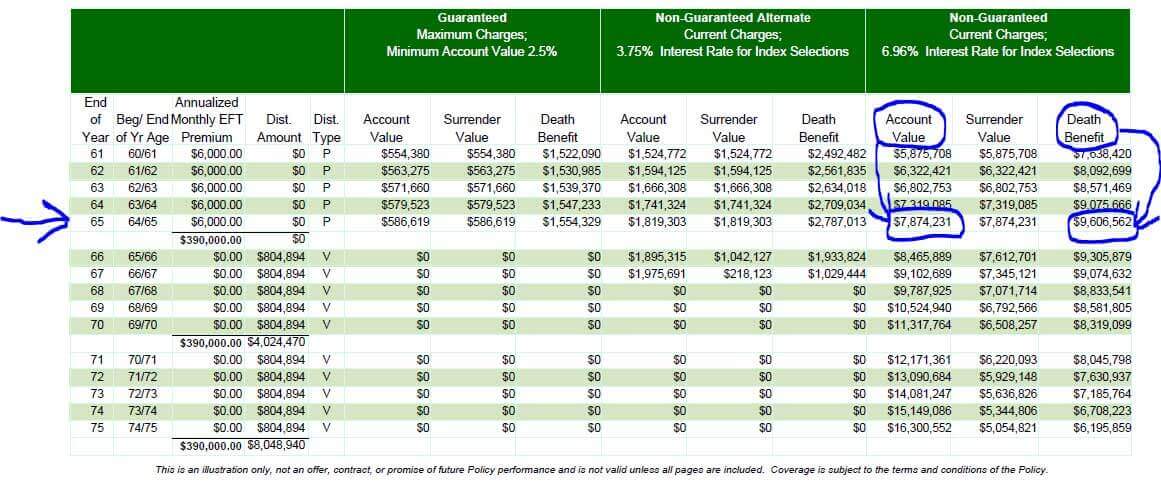

As outlined previously, IUL plans have different fees. Understand these prices. This figures out just how much of the index's gains add to your cash money value development. A greater rate can boost prospective, however when contrasting policies, evaluate the cash money value column, which will help you see whether a greater cap price is better.

Indexed Universal Life Loan Options

Various insurance companies use variants of IUL. The indices linked to your plan will directly influence its performance. Flexibility is important, and your policy must adapt.

Table of Contents

Latest Posts

Indexed Whole Life

Index Life Insurance Vs Roth Ira

Iul For Retirement Income

More

Latest Posts

Indexed Whole Life

Index Life Insurance Vs Roth Ira

Iul For Retirement Income